Detergent Powder PDF [PDF]

DETERGENT POWDER AND CAKE CONTENTS SECTION I PRODUCT CHARACTERISTICS AND SPECIFICATION SECTION II PRODUCT APPLICATI

45 0 174KB

Papiere empfehlen

![Detergent Powder PDF [PDF]](https://vdoc.tips/img/200x200/detergent-powder-pdf.jpg)

- Author / Uploaded

- Shakeel Najmi

Datei wird geladen, bitte warten...

Zitiervorschau

DETERGENT POWDER AND CAKE CONTENTS SECTION

I

PRODUCT CHARACTERISTICS AND SPECIFICATION

SECTION

II

PRODUCT APPLICATIONS

SECTION

III

INDIAN DETERGENT INDUSTRY STATUS

SECTION

IV

INDIAN MANUFACTURERS

SECTION

V

IMPORT/EXPORT LEVEL

SECTION

VI

PRICE TRENDS

SECTION

VII

INDIAN DEMAND

SECTION

VIII

BROAD OUTLINE OF MANUFACTURING PROCESS

SECTION

IX

RAW MATERIALS REQUIREMENTS, UTILITY AND AVAILABILITY

SECTION

X

GLOBAL SCENARIO

SECTION

XI

DISCUSSIONS ON ECONOMIC CAPACITY, PROJECT COST AND PROFITABILITY PROJECTIONS

SECTION

XII

SWOT ANALYSIS

SECTION

XIII

FACTORS INFLUENCING THE POSITION FOR A NEW INDUSTRY AND RECOMMENDATIONS

1

SECTION - I PRODUCT CHARACTERISTICS AND SPECIFICATION Formulation Synthetic Detergents are formulations comprising surfactants like alkyl benzene sulphonate, fatty acid soaps, fatty alcohol, ester and similar compounds, bleaching, optical brighteners, phosphates and anti-redeposition agents, fabric softeners and certain other chemicals to improve the detergent action. Classification Classified either based on the charge on the organic part of the detergent (like anionic, cationic or non-ionic) or on the case with which they decompose into smaller units which would no longer foam (bio degradable or soft detergents and non bio degradable or hard detergents). Use pattern Anionics are the most commonly used detergents for washing and cleaning applications, while cationic (with germicidical characteristics) and non-ionics (with low foaming propertion) are mainly used for industrial applications. The traditional heavy-duty laundry powder contains approximately 15% active surfactant, often Acid slurry (Linear alkylbenzene sulphonate). The builder has traditionally been Sodium tripoly phosphate (STPP) at an average level of 20 to 25%. This phosphate builder is added to help soften the water.

SECTION - II 2

PRODUCT APPLICATIONS

*

Household and industrial cleaning

*

Fabric washing powders, bars, liquids.

*

Dish washing powder or liquid.

*

General purpose cleaning powders or liquids.

*

Toilet cleaners- blocks or liquids.

SECTION III 3

INDIAN DETERGENT INDUSTRY STATUS

3.1.

Production trends for soaps and detergents 40 35.92

Soaps

35

37.72

Synthetic Detergents 31.79

30 24.89 21.83 15.75

14.25

Source : Indian Soaps and Toilet Manufacturer Association Business Line 3.2.

Growth rate in demand

3.2.1. Soap Weighted Average annual growth rate in demand

:

7 to 9% per annum

:

11 to 14% per annum

3.2.2. Detergents Weighted Average annual growth rate in demand

4

2000

5.7

6.77

1999

1997

1996

Year

5.23

6.21

1998

4.8

4.5 1995

4.15

3.8

3.5

19.15

7.51

1993

3.3

1992

1987

2.78

1988

2.57

0

11.75

3 1989

8

5

10.5

9.15

1991

10

12.95

17.35

1994

15

7.89

2001

20

1990

in Lakh tonnes

28.13 25

3.3.

Market share of Major players

3.3.1. Toilet Soaps

Nirma 15%

Hindustan Lever 65%

Godrej Soaps 8% Colgate Palmolive Others 5% 7%

3.3.2. Detergents Karnataka Soaps

Unorganised 29% sector

2%

Henkel SPIC

P&G 10%

2%

Nirma 29% HindustanLe ver

29%

5

3.4.

Fabric wash market structure

The estimated production of synthetic detergents including powders and bars is approximately 36 lakh tonnes in 1999. The ratio of powder to bar is 60 : 40.

Bars 40%

Powders 60%

The detergent powder segment caters to three categories, lower, middle and higher end markets.

6

3.5.

Urban , Rural Market share Detergent Bars

Detergent Powders

Rural 60%

Urban 60% Rural 40%

Urban 40%

Laundry Soaps Rural 70%

Urban 30%

Percapita Consumption of Synthetic detergents in India (average) 2.5 to 3 kg

7

3.6.

Characteristics of the Detergent market

More users opt for the convenience of detergent powders over bars. Powder usage would improve as more users change their washing habit, in favour of bucket wash. Studies show that usage of synthetic detergents such as Surf, Ariel and Henko, has increased, compared to the conventional detergent bars that were produced with vegetable oils. 3.7.

Market initiatives

Industry majors have been kept busy evolving responses to the challenges of growth in the detergent industry. Faced with distinctly sluggish volume growth, Hindustan Lever launched a rural initiative to enhance the penetration of its products. Procter and Gamble Home Products took a very different approach of streamlining its distribution network and reducing the number of stockist, in an effort to cut costs. HLL also put through de-bottlenecking and cost-cutting measures at Vashisti Detergents, in which it has a stale. Nirma, in an effort to cut costs, launched a series of ambitious backward integration projects; completed, it will manufacture practically every key input. Henkel SPIC, a relatively recent entrant into the market, waited two years and spent Rs.60 crores to acquire control over key brands of Shaw Wallace group companiesCalcutta Chemicals and Detergents India Ltd. The company, which made a rights offer to fund the acquisition, hopes these brands will give it the critical mass when it comes to competing with the heavyweights. 3.8.

Growth trends of the industry

In terms of value, the Rs.4,000 crore detergents market is among the largest FMCG categories in India, next only to edible oils and biscuits. The Indian market for detergents is among the largest in the world. Volume growth can be impacted by a variety of factors. Plateauing of demand in the urban market and a slowdown in the rural offtake due to a fall in disposable incomes are factors which could have had an impact on volumes. Another is consumer resistance to sharp increases in the selling price by most manufacturers in late 1990’s. 3.9.

Resurgence in rural demand 8

For players such as Hindustan lever, the recovery in volume growth has been spurred by a resurgence in rural demand in 1999 first half. According to CMIE statistics, agricultural output in 1998-99 was higher by 6.8 percent after declining by 5.4 percent the previous year. This is likely to have left consumers in rural areas with higher disposable incomes. Mr.Arun Adhikari, Vice-President, Marketing (Soaps and Detergents)), Hindustan Lever feels the recovery in 1999 can be attributed entirely to higher rural disposable incomes, after the contraction in the rural economy over the past two years. “:We can see this in the kinds of brands, pack sizes and markets that the growth is coming from. The growth in 1999 has come from the Northern and Eastern Markets which were depressed earlier, where consumption has been low”. Higher sales growth has been one reason why the major players have been able to put up a reasonable show in recent years. But what probably brought about the dramatic turnaround in financial performance in 1999 is the sharp improvement in profit margins in the business. 3.10.

Outlook

With the industry getting intensely competitive and with most players focussing on the discount segment, the cost reduction has been an important pre-occupations for the major players. The companies have been trying to streamline their distribution systems, trying to bring down inventories, margins and other wastages in the system. The introduction of IT based systems, such as Enterprise Resource Planning, for production planning and control also has the potential for substantial savings. Apart from trying to squeeze out higher profit margins, players are also continuing their efforts to pep up sales growth. The rural market, despite the high penetration levels, is seen as one high growth area.

9

SECTION IV INDIAN MANUFACTURERS OF SOAPS AND DETERGENTS

A number of soaps and detergent units are in the unorganised sector and distributed all over the country. The important soaps and detergents units include the following *

Acme Synthetic Chemicals/Acme Soap Works, 308, Veer Savarkar Marg, Dadar,Mumbai 400 028

*

Adnoc Chemicals, II, G/F, Reddy Hostel Complex, Tilak Road, Hyderabad - 500 001.

*

Anand Chemicals 7th Cross, PIPDIC Industrial Estate Sedarapet-605 111

*

Bharani Chemical Industries, 41, Chairman Muthuramier Road,Madurai-625 009.

*

Belchem Industries India P.L. 69 A Poona Link Road Chakki Naka-421 306 Kalyan East, Maharashtra

*

Colgate Palmolive (India) Ltd., 3rd Floor, Vaswani Mansion, Dinshaw Vachha Road, Churchgate, Mumbai-400 020.

*

Detergents India Ltd., Kodur-516 101 Phone : (08566) 44018, 44038, 44048

*

Diverseylever, Hindustan Lever Ltd., Haji Bunder, Sewree, Mumbai-400 015.

*

Godrej Soaps Limited/Godrej & Boyce Mfg. Co. Ltd./ Godrej Hi Care Ltd. Gate 1A, Godrej Soaps Complex, Plant 4 Pirojshanagar, Eastern Express Highway, Vikhroli (East), Mumbai-400 079. 10

*

Girijan Cooperative Corporation Ltd., Opp. New VUDA Park, East Point Colony, Visakhapatnam-530 017,

*

Hindustan Lever Limited, Chemicals Division, ICT Link Road, B.D. Sawant Marg, Chakala, Andheri (East), Mumbai-400 099.

*

Henkel SPIC India Ltd., (Formerly known as SPIC Fine Chemicals Ltd.) Peralam Main Road, Thirunallar, Karaikal-609 607. Office :

Temple Tower, Third Floor, 476/6, Anna Salai, Nandanam, Chennai-600 035.

*

Hipolin Limited 4th Floor, Madhuban, Near Madalpur, Ellisbridge, Ahmedabad-380 006

*

Jindal Soaps and Detergents Pvt. Ltd., 503/2, Gayatri Chambers R.C.Dutt Road, Vadodara.

*

Jagdish Chemicals Plot No. 4718, GIDC., Ankleshwar, Bharuch-393 002

*

Jocil Ltd., (A Subsidiary of The Andhra Sugars Ltd.,) P.O. Box 216, Arundelpet, Guntur - 522 002 (A.P.) Factory & Regd. Office

: Dokkipudur,Gunthur 522 438 Andhra Pradesh.

*

Jaya Soaps 89/1-A, Pannithittu Road, Ponvandu Complex, Kirumampakkam-607 402

*

Kalaivani Soap Works A-10, Rural Industrial Estate, Kattukuppam, Pondicherry-607 402

11

*

Karnataka Soaps and Detergents Limited (A Government of Karnataka Undertaking) Regd. Office & Factory: P.B. No.5531, Bangalore-Pune Highway, Rajajinagar,Bangalore-560 055.

*

Kerala State Detergents & Chemicals Ltd., (A Government of Kerala Enterprise), Office & Factory: Kuttipuram-679 571,

*

Kerala Soaps & Oils Ltd., (Govt. of Kerala Enterprise) West Hill,Calicut 673 005

*

Memba Chem Industries Pvt. Ltd. 19, M.J. Building, Ground Floor, 187 Princess Street, Mumbai-400 002

*

Muller & Phipps (India) Ltd. Queen' s Mansion, P.O. Box No.773 Amrit Keshav Naik Marg Mumbai

*

Nirma Limited, Nirma House, Ashram Road,Ahmedabad-380 009. Factory Add: Block No. 16B, Ahmedabad Mehsana Highway, P.O. Mandali, Tal. Dist. Mehsana

*

Neemtal Products 48, Dhanalaxmi Avenue, 1st Floor, Kashuriba Nagar, Adyar, Chennai-600 020

*

Nived Chemical Industries Office: 6/1, Manjanakara St., Madurai 625 001. Factory: 20-A, New Mahalipetti Road, Madurai 625 001.

12

*

Procter & Gamble Hygiene and Health Care Ltd., (Formerly Procter and Gamble India Ltd.,) Tiecicon House,Dr.E Moses Road, Mumbai-400 011.

*

Pond' s (India) Ltd., GST Road, Chromepet, Madras 600 044. C-60/69, PIPDIC Indl. Estate, Mettuplayam, Pondicherry 605 010

*

Reckitt & Colman of India Ltd. Factory : 176, Sipcot Indl. Complex, Hosur-635 126. Office : 41, Chowringhee Road, Calcutta-700 071.

*

Sun Chemicals Office Factory

6/1, Manjanakara St., Madurai 625 001 63/5, Viraganoor Village, Madurai 625 009.

*

Sadhna Soaps Sadhna Indl. Estate, S.V. Road, Oshiwara, Jogeshwari (W) Mumbai-400 102

*

Swastik Surfactants Ltd., 1st Floor, Industry Manor, 442 A Marathe Marg, Prabhadevi,Mumbai-400 025.

*

Sree Rayalaseema Alkalies & Allied Chemicals Ltd., AS10 Gondiparla,Kurnool -518 004.

*

Sri Chemicals, A-5, Fishing Harbour,Visakhapatnam - 530 001.

13

*

Sree Krishna Chemical Industries Arya Griha, Vadakkevila P.O., Kollam-691 010, Kerala

*

Soybean Detergents Pvt. Ltd., No.23/1, T.T.K.Road, 1st cross, Sri Ram Nagar, Alwarpet, Madras-600 018. Factory

:

No.9, G.K. Indl. Estate, Arcot Road, Porur, Madras-600 116.

*

Trimen Hygiene Products G-5/87, Teachers Colony Namakkal-637 0001

*

Tata Chemicals Ltd. Chemical Complex and Cement Plant: Mithapur, Okhamadal -361 345, Dist. Jamnagar. Bombay House, 24, Homi Mody Street, Mumbai 400 001 Detergent Plant: Pithampur Dist. Dhar, M.P.

*

Thirumala Soap Works 20, Rural Industrial Estate, Kattukuppam, Pondicherry-607 402

*

Ultramarine & Pigments Ltd., Ultramarine Blue Division, No.556, Vanagaram Road, Ambattur, Madras-600 053. Detergents Division : Plot No.25-B, SIPCOT Indl. Complex, Ranipet-632 403. 25-B, Sipcot Industrial Complex, Ranipet-632 403, Vellore District,

*

Varuni Chemicals (P) Ltd. Admn. Office : 6/1,Manjanakara Street,Madurai-625 001.

14

Office : Factory

:

72, Medavakkam Tank Road, Kilpauk, Chennai-600 010. 63/5, Viraganoor Village, Madurai 625 009.

*

Vasu Chemical Industries, Plot No.26-A & 41,Guindy Indl. Estate (North), Ekkaduthangal, Madras-600 097.

*

Vashisti Detergents Ltd., Plot No.B-7, MIDC Lote Parshuram, Tal. Khed, Dist. Ratnagiri, Maharashtra-415 722.

*

Victory Soap Works A-115, PIPDIC Industrial Estate, Mettupalayam-605 009

15

SECTION - V IMPORTS/EXPORT DETAILS 5.1.

Present Import level

:

Around 2200 tonnes per annum

Countrywise Imports of Other Washing Prpns & Cleaning Prpns Synthetic Detergents Period April 2001 to March 2002 Country

Quantity in Kgs

Australia Austria Belgium Brazil Canada Chinese Taipei China P RP Czech Republic Denmark France German F REP Hong Kong Indonesia Ireland Israel Italy Japan Korea RP Malaysia Mexico Netherland Nigeria Norway Oman Philippines Poland Singapore Spain Sweden Switzerland Thailand Turkey U Arab Emts UK USA Unspecified

5655 9810 57390 55 3900 9430 18890 10 1696 52764 600393 2129 3840 50 50 205850 177206 11825 9305 1000 136462 204 11110 1 322 1250 108718 34351 75264 131176 4859 300 2249 284234 181671 100 16

Sample of individual imports of Detergent Period 2002 Name of the Importers

Value in Rs.

Country

Date

Port

Epcos India Ltd.,

Quantity in tonnes 0.150

44607

Germany

Mumbai

Saf Yeast Co.Ltd.,

0.420

48258

Belgium

Lavino Kapur Cotton Ltd., Dexo India Crome Prod.

2.880

205926

Germany

5.000

29170

Malaysia

0.310

44335

Germany

11.02.2002 to 19.02.2002 01.05.2002 to 05.04.2002 08.05.2002 to 14.05.2002 06.02.2002 to 10.06.2002 17.09.2002 to 24.09.2002

Lavino Kapur Cotton P.Ltd., 5.2.

:

Present Export level

Around 6500 tonnes per annum

Countrywise Exports of Other Washing Prpns & Cleaning Prpns Synthetic Detergents Period April 2001 to March 2002 Country

Quantity in Kgs

Angola Australia Baharain IS Bangladesh Benin Cameroon Chad Chinese Taipei China P RP Comoros Congo P REP Cyprus Djibouti Egypt A RP Ethiopia Fiji IS Gabon Gambia German F REP Ghana Guam Guniea Guinea Bisu

1206 213000 10000 103055 70630 64600 229100 57600 4040 10000 18720 6000 39500 10000 55000 20000 25261 8495 480 101214 8600 19029 9736 17

Mumbai Mumbai Mumbai Mumbai

Haiti Hong Kong Indonesia Iran Kanzakhstan Kenya Kuwait Maceoernia Malagasy RP Malawi Malaysia Maldives Mali Malta Mauritania Mauritious Morocco Mozambique Namibia Nepal Netherland New Zeland Nigeria Oman Papua N GNA Philippines Reunion Saudi Arab Seychelles Singapore South Africa Sri Lanka Tanzania REP Thailand Togo Trinidad Uganda U Arab Emts Ukraine USA Vietnam SOC REP Yemen Republc Zambia

26000 39100 17405 300 5000 450 52200 25725 71050 34000 640702 16000 29500 10000 38625 251777 18004 19200 15000 238510 6000 11800 93900 269500 24000 1978302 6026 13200 15810 15000 56182 129226 6000 10700 67000 8000 35381 686184 1300 145497 71100 86200 2720

18

Sample of individual exports of Detergent Period 2002 Name of the Exporters

Value in Rs.

Country

Date

Port

Artek Surfin Chemicals

Quantity in tonnes 1.500

49698

Dubai

Mumbai

SSA Impex

5.500

933625

Duabi

Sangam Organic Chemls

21.600

377325

Rashid

Henkel-Spic India Ltd.,

102.000

1317939

Muscat

01.0.2002 to 15.02.2002 01.03.2002 to 15.03.2002 11.07.2002 to 31.07.2002 01.08.2002 to 13.08.2002

19

Mumbai Chennai Chennai

SECTION - VI PRICE DETAILS Basic price for Detergent Cake

: :

Rs.45 per kg. Rs.32 per kg.

Taxes and duties

:

Extra as applicable

Price fluctuation The selling prices of major detergent brands were hiked (much of it in the mid-priced to medium segments) by between 9 percent and 25 percent in recent times, in response to rising production costs. For instance, price increases in the case of brands such as Nirma Popular and Wheel Green were around 8 percent. Selling prices of products in the mid price segment, such as Ariel Supersoaker, were hiked 20 to 25 percent, while that of those in the premium end, such as Surf Excel, Henko Stain Champion were raised 10 to 12 percent.

20

SECTION -VII INDIAN DEMAND

ISTMA (Indian Soaps and Toilet Manufacturer Association) has estimated the Indian detergent bars and powders demand to be in the region of 3.5 million tonnes per annum Per capita consumption of detergent on all India basis is around 2.5 to 3 Kg, which could vary between different regions depending upon the prevailing economic and social conditions. Likely growth rate in demand

7 to 8% per annum

21

SECTION -VIII BROAD OUTLINE OF MANUFACTURING PROCESS 1.

General details

1.1.

Liquid detergents

Liquid detergents can be manufactured in batches ranging from 5 to 100 kgs. A 5kg batch can be conveniently prepared in stainless steel vessels or HDPE containers by manual stirring. The required quantity of acid slurry is weighed in the container and an equal quantity of water is added. 15% caustic soda solution is gradually added with stirring till pH is brought to 7 as indicated by colour change, of a narrow range pH paper. External cooling of the vessel is essential during neutralisation of the acid slurry. Sodium sulphate is added and diluted by addition of water. Urea is added at this stage along with perfume and stirring is continued for a further 10 minutes. The liquid gradually clarifies after being allowed to settle for about 3 to 4 hours, after which the contents of the vessel are filtered and bottled. 1.2.

Extruded cakes/bars

Acid slurry is neutralised with soda ash and mixed in a sigma mixer. The other ingredients are added in the following sequence with continued mixing. a) b) c) d) e)

Talc and kaolin Sodium silicate and water Paraffin wax Starcgh, colour, optical whitener, perfume STPP

The mixing is carried out for a further 10 minutes after which the plastic dough obtained is milled through a triple roller mill and transferred to an extruder. The temperature of extruder is maintained at 60 deg.C and the extruded bars are cut and stamped. The stamped cakes are allowed to age under a current of coldair for nearly 8 hours, after which the cakes/bars are wrapped. 1.3.

Mechanically pressed tablets

The ingredients are either mechanically mixed or hand mixed as detailed under extruded cakes/bars. A dough soft enough for tableting is thus obtained. Homogeneity of the dough is to be ensured at this stage and, if required,mixing should be continued. Individual portions corresponding to the exact weight of the final tablet are fed to the mechanically operated tableting machine and stamped. The stamped tablets are allowed to age for at least 8 hours, after which the tablets are wrapped.

1.4.

Selected formulations for detergents

Listed below are some typical formulations based on Acid slurry, which can be readily adopted for the manufacture of detergents even in manually operated units. 22

Detergent powders (household)

in Wt, %)

85% active LAB acid slurry Sodium carbonate (soda ash) Sodium meta silicate Alkaline sodium silicate

Premium grade 18 35 2 -

Popular grade 15 32 7

10 20 10 1.5 0.1 0.3 0.1 3

10 25 7 1.0 0.1 0.2 0.1 2.6

Sodium bicarbonate Sodium sulphate (anhydrous) Sodium tripolyphosphate Sodium carboxy methyl cellulose Phthalocyanine blue colour or oil soluble yellow colour Optical whitener Perfume Water

Liquid detergents 85% active LAB acid slurry Caustic soda Sodium sulphate Urea Perfume Water

in Wt % Light duty 20 Quantity required to bring pH to 7 2 10 0.1 q.s

Detergent cakes/bars/tablets 85% active LAB acid slurry Soda ash Sodium silicate STPP Starch(tapioca/maize) Talc Kaolin Paraffin wax Opt., whitener Colour Perfume Sodium sulphate Water

Extruded bars/cakes 18 15 10 15 20 10 3 4 0.3 0.05 0.1 q.s

23

Heavy duty 25 quantity required to bring pH to 7 2 15 0.1 q.s.

in Wt, % Mechanically pressed tablets 16 20 10 10 15 12 0.3 0.1 0.1 10.0 q.s

Historical details In India, the first detergent powder (spray dried) was produced by Swastik Oil Mills Ltd., Bombay, in the year 1957. The composition of the powder at that time was as follows: Hard Sod.ABS CMA STPP Silicate(100% basis) CMC Tinapol Perfume Sodium Sulphate Water

20% 2% 35% 7% 1% 0.2% 0.2% 24% 8%

STPP : The STPP content was quite high in this formulation. This practice of using high STPP continued to prevail in the Western Countries until the recent years, when restrictions were imposed on the use of STPP. In India, the STPP content in the premium products was gradually reduced due to economic reasons and now it has come down to 20%. Soda Ash : Also, for a number of years, the premium detergent powders in India did not contain Soda ash. In recent years, use of about 10% Soda ash has been observed in the premium powders. Silicate content.

:

The silicate level has gone up consequent to the reduction in STPP

The average formulation of a present day premium spray dried detergent powder LABS STPP Alkaline Silicate(100%) Soda ash CMC Optical brightener Perfume Sodium sulphate Water

20% 20% 15% 10% 1% 0.2% 0.2% 25% 10%

24

The average formulation of Hand mixed powder The hand-mixed powder came into vogue only about 2 decades ago. The quality of this powder has remained unchanged during this period. The general composition of handmixed powder, which is mostly yellow coloured is as follows: Soda ash Labs Water

68 to 70% 12 to 13% 18 to 20%

CMC is normally absent in these products. Recent trends in formulation : The recent trend in India is to use a mixed active system in detergent powders for better performance at a lower cost. For example, in a dry mixed powder, instead of using 12% LABS, a mixture of 8% LABS and 2% AOS can be used. Similarly, in premium spray dried powders, the performance can be improved by using a mixture of 14% LABS and 3% AOS in the place of 20% LABS. Special Liquid detergent The liquid detergent products in India are mostly of the dish washing type. Basically, they consist of a solution of sodium alkyl benzene sulphonate in water, using urea as solubilising agent. There are a few special liquid detergents in the Indian market, which are recommended for woollen, silk and other fire expensive garments. The detergent active used in such formulations has to be of the rigid type. S Toyoda of Lion Fat & Oil Co., Japan had worked on the suitability of various detergent actives for washing woolen and acrylic fibre. This observations are reproduced below:

LAS Alcohol sulphate Alcohol Ether Sulphate Secondary Alcohol Ethoxylate Alpha Olefin Sulphonate

Wool

Acrylic

Not good Excellent Not good Not good Excellent

Fairly good Not good Not good Not good Excellent

The most suitable detergent active for wool and acrylic is AOS. A liquid detergent based on AOS is already in the Indian market. 25

Concentrated detergents During the past two years, a new trend has been seen in the Indian market. It is the introduction of very expensive detergent powders. These are highly concentrated powders containing more than 25% detergent actives and more than 25% STPP. Some powders contain a bleach along with a low temperature bleach activator. Most of them contain enzymes. These are heavy powders manufactured by agglomeration technology. Source of technology *

Central Salt and Marine Chemicals Research Institute, (Council of Scientific & Industrial Research) Gijubhai Badeka Marg, Waghawadi Road Bhavnagar -364 002

Major plant & machinery and suppliers Name of the equipment Reactors

Name of the supplier Chemitherm Plants & Systems P. Ltd., 30, Anandha Street Alwarpet, Chennai-600 018 Texel Fabricators Pvt. Ltd., 335, Sidco Industrial Estate, Ambattur, Chennai-600 098, Tamil Nadu

Neutraliser

Sharplex Agro Process (I) Pvt. Ltd., 302, Hill View Industrial Estate, LBS Marg Ghatkopar (W), Bombay-400 086

Pulveriser

ACE Pack Machines 23, V.N. Industrial Estate Bharathi Colony,Near Athiparasakthi Temple Peelamedu, Coimbatore-641 004 Frigmaires Engineers PO Box 16353, 8, Janata Industrial Estate Senapati Bapat Marg Opp Phoenix Mill, Lower Parel (W) Mumbai-400 013

Blender

ACE Pack Machines 23, V.N. Industrial Estate Bharathi Colony,Near Athiparasakthi Temple Peelamedu, Coimbatore-641 004

26

SECTION IX RAW MATERIAL REQUIREMENTS, UTILITY AND AVAILABILITY Raw material requirements Detergent powder : 600 tonnes per year Acid slurry Soda ash Sodium bicarbonate Sodium tripolyphosphate Trisodium phosphate Sodium sulphate Sodium meta silicate CMC Colour Perfumes Optical whitener

0.20 tonne 0.40 tonne 0.05 tonne 0.15 tonne 0.03 tonne 0.05 tonne 0.05 tonne 0.02 tonne 2.5 kg 1.5 kg 0.002 tonne

Detergent cakes : 300 tonnes per year Acid slurry Soda ash Starch Talc Sodium silicate STPP

0.12 tonne 0.06 tonne 0.048 tonne 0.36 tonne 0.36 tonne 0.08 tonne

Utilities Power

70 HP for the project of capacity 600 tonnes per annum.

Raw material availability Name of the raw material

Name of the supplier

Acid slurry

Bharani Chemical Industries, Gee Gee Khay Chemical Industry, Varuni Chemicals (P) Ltd

Soda ash

Atul Ltd., Gujarat Birla VXL Ltd., Jamnagar DCW Ltd, Mumbai Gujarat Heavy Chemicals Ltd., Gujarat Tata Chemicals Ltd., Jamnagar

27

Sodium bicarbonate

Birla VXL Ltd., Jamnagar DCW Ltd, Mumbai Tata Chemicals Ltd., Jamnagar

Talc

Mountain Microns and Minerals Ltd., Vadodara Famous Minerals and Chemical Co., Mumbai Kalpana Minerals Pvt. Ltd., Mumbai

Sodium tripoly phosphate

Albright and Wilson Chemicals Co. Ltd., Mumbai Hindustan Lever Ltd., West Bengal

Trisodium phosphate

Albright and Wilson Chemicals Co. Ltd., Mumbai AVA Chemicals Pvt. Ltd., Mumbai

Sodium sulphate

Jeyes Nitrochemical Pvt. Ltd., Chennai Baroda Rayon Corporation Ltd., Surat

Sodium meta silicate

Ricasil Industries, Gujarat Sapana Industries, Gujarat Aarti Ice Factory, Ambernath

CMC

E.P. Industrial & Agro Chemicals Pvt. Ltd.,Secunderabad Reliance Cellulose Products Ltd.,Secunderabad Meridian Chem-Bond Ltd.,Gujarat

28

SECTION X GLOBAL SCENARIO

US detergent Scenario 1.

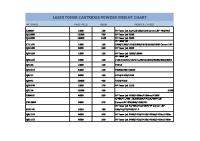

US Laundry detergent market (in millions of dollars)

Brand

Manufacturer

Tide All Purex Wisk Era Cheer Xtra Arm & Hammer Surf Gain Dreft Private Label Total

Procter & Gamble Unilever Dial Unilever Procter & Gamble Procter & Gamble USA Detergents Church & Dwight Unilever Procter & Gamble Procter & Gamble Various

2.

Liquid Sales

% Change from 1998 12.0% 11.0 31.8 -0.2 -4.4 6.8 14.0 14.3 2.9 67.8 -NA 11.4

$872 287 234 232 149 143 130 90 84 83 -73 2678

Market Share

Powder sales

32.5% 10.7 8.7 8.6 5.5 5.3 4.8 3.3 3.1 3.0 -14.5 58.0%

$902 51 72 61 -181 -122 147 213 38 53 2044

Laundry detergent market share in US

Procter & Gamble 57% Dial 7% Church & Dwight 5%

Reckit & Benckiser 1% Huish 1% LaCorna 1%

Colgate Palmolive 4% USA Detergents 3% Unilever 18%

29

Private Label 3%

% change from 1998 -1.4% 1.0 -7.7 -13.7 --7.0 --0.4 -2.2 13.7 -0.7 -8.4 -2.3

Market share 44.0% 2.4 3.5 2.9 -8.8 -5.9 7.1 10.4 1.8 2.5 42.0%

3.

Personal care market share in US

Procter & Gamble 21%

Dial 15% Others 16%

Kao 2% Unilever 33% Colgate Palmolive 13%

2

Japan Scenario

2.1.

Estimated Soaps and detergents market shares in 1999.

Lion 30%

Procter & Gamble 20%

Kao 40% Unilever 10%

30

SECTION - XI

DISCUSSIONS ON ECONOMIC CAPACITY, PROJECT COST AND PROFITABILITY PROJECTIONS Installed capacity

Detergent Cakes

: :

Total Project cost

600 tonnes per annum 300 tonnes per annum Rs.94 lakhs

Assessment of project cost 1.

Land

S.No.

Description

1.1 1.2

Cost of land of 0.5 acre at Rs.5.5 lakh per acre Cost of levelling, laying internal roads/fencing and compound wall Subtotal

2.

Cost Rs.in lakhs 2.75 0.28 3.03

Building

S.No.

Description

2.1 2.2

Factory building of area 170 sq.m. at Rs.3200/sq.m. Non-factory building of area 80 sq.m.at Rs.4500/sq.m. Subtotal

3.

Cost Rs.in lakhs 5.44 3.6 9.04

Cost of Plant & Machinery

S.No.

Description

Cost Rs.in lakhs 13 0.98 1.3 0.65

3.1 3.2 3.3 3.4

Cost of basic plant and machinery Instrumentation and control Pipelines and valves Structurals for erection

3.5 3.6 3.7 3.8 3.9 3.10

Subtotal Octroi, excise duty, sales tax, etc.at 12% Packaging and insurance charges (2%) Transportation charges (2%) Machinery stores and spares (2%) Foundation charges (2%) Installation charges (2%) Total cost of plant and Machinery 31

15.93

1.91

0.32 0.32 0.32 0.32 0.32 19.44

4.

Technical know-how fees

5.

Miscellaneous fixed assets

Rs.2.50 lakhs

S.No.

Description

5.1. 5.2. 5.3. 5.4. 5.5. 5.6. 5.7.

Electrification Steam boiler and auxillaries Water storage tank, borewell etc. Fuel storage tank Laboratory equipment Office machinery & equipment Material handling equipment, packaging machinery, weigh balance, etc. Diesel generator Effluent treatment Total

5.8. 5.9. 6.

Cost Rs.in lakhs 3 4 0.8 0.8 1.2 0.8 0.8 4.5 0.8 16.7

Preliminary & Pre-operative expenses:

S.No.

Description

6.1. 6.2. 6.2.1 6.2.2 6.2.3 6.2.4 6.2.5 6.2.6 6.2.7

Preliminary expenses Pre-operative expenses:Establishment Rent rates and taxes Travelling expenses Interest and commitment charges on borrowings Insurance during construction period Other preoperative expenses and deposits Interest on deferred payment Total

Cost Rs.in lakhs 0.8 0.8 0.8 0.8 7.0 1.8 12

7.

Provision for contingency

Rs. 3.78 lakhs

8.

Working capital margin

Rs.27.32 lakhs

9.

Total project cost

Rs. 93.81 lakhs Say Rs.94 lakhs

10.

Means of Finance

Promoter's contribution Term loan from financing institutions Total project cost

Rs.38 lakhs Rs.56 lakhs Rs.94 lakhs

32

11.I.

Financial Statements

A

Variable Cost

Rs.in lakhs

Raw material and utilities Spares and maintenance Selling expenses Total variable cost B Fixed cost

213.5 1.2 18.3 233

Salaries and wages Interest on term loan and working capital loan Depreciation Administrative expenses Total fixed cost C. Total cost of production A + B D. Selling price per kg. (in Rupees) Detergent Cake E. Annual sales turnover (Rs.in lakhs) F. Net profit before tax (Rs.in lakhs) (E-C)) G. Breakeven point in %

15 24.83 3.36 10.98 54.17 287.17 150 45 32 366 78.83 41%

33

SECTION XII SWOT ANALYSIS Strength

Large percentage of the households in India are already using the soaps and detergents , notwithstanding the low per capita consumption.

Weakness

Poor buying power of the average citizen

Opportunity

The market can application efforts

Threat

Higher price segment product are unlikely to enjoy large demand

34

be

developed

by

SECTION XIII FACTORS INFLUENCING THE POSTION FOR A NEW INDUSTRY AND RECOMMENDATIONS The Indian soaps and detergent industry, backed by a countrywide retail network of retailers, numbering nearly seven million, can grow significantly given further reductions in excise tariffs. These duties should be further reduced in order to stimulate demand. In India, the most important criterion in formulation of detergent is the cost. consumer relates the performance to the price of the product.

The

The market is heavily skewed towards lower price products, as the entire Indian fabic wash market and indeed the carbolics and the popular brands account for about 40% each of the total market. Detergent industry represents good investment opportunity in the small and medium sector.

35